Derivatives and Hedging

Choosing the Right Delivery Month in Futures Hedging: Why a Later Date is Often Better

Discover why choosing a later delivery month in futures hedging can offer better protection and flexibility for your investment strategy.”

Updated on

Derivatives and Hedging

CDS Spread and Bond Yield Spread Relationship

Understand the relationship between CDS spreads and bond yield spreads, their significance, and impact on credit risk assessment.

Updated on

Derivatives and Hedging

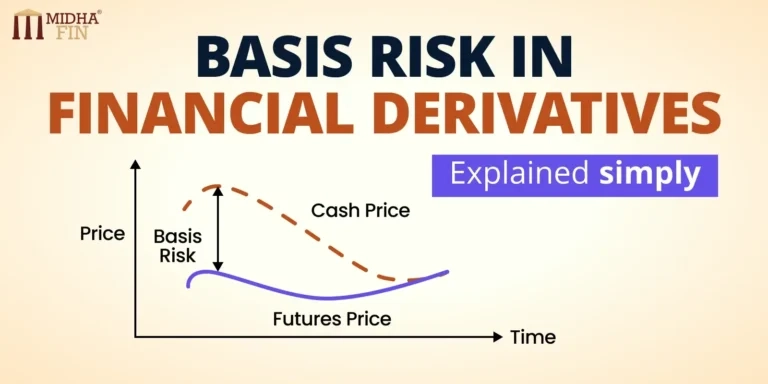

Basis Risk in Financial Derivatives – Understanding and Managing

Understand basis risk in financial derivatives, its key components, influencing factors, real-world examples, and effective management.

Updated on

Derivatives and Hedging

Delta Hedging

Delta-Gamma hedging offers superior control over option portfolios by addressing the limitations of Delta Hedging’s linearity.

Updated on

No more posts to load