Derivatives and Hedging

Basis Risk in Financial Derivatives – Understanding and Managing

Basis risk in financial derivatives might sound complex, but it’s simply about the mismatch that can occur when a hedge doesn’t move in sync with its underlying asset. This risk is something everyone in finance, particularly in risk management, needs to understand to make better decisions and avoid unexpected financial hits. Let’s break down basis risk into easy-to-grasp components, see what affects it, and learn how to manage it effectively.

What is Basis Risk?

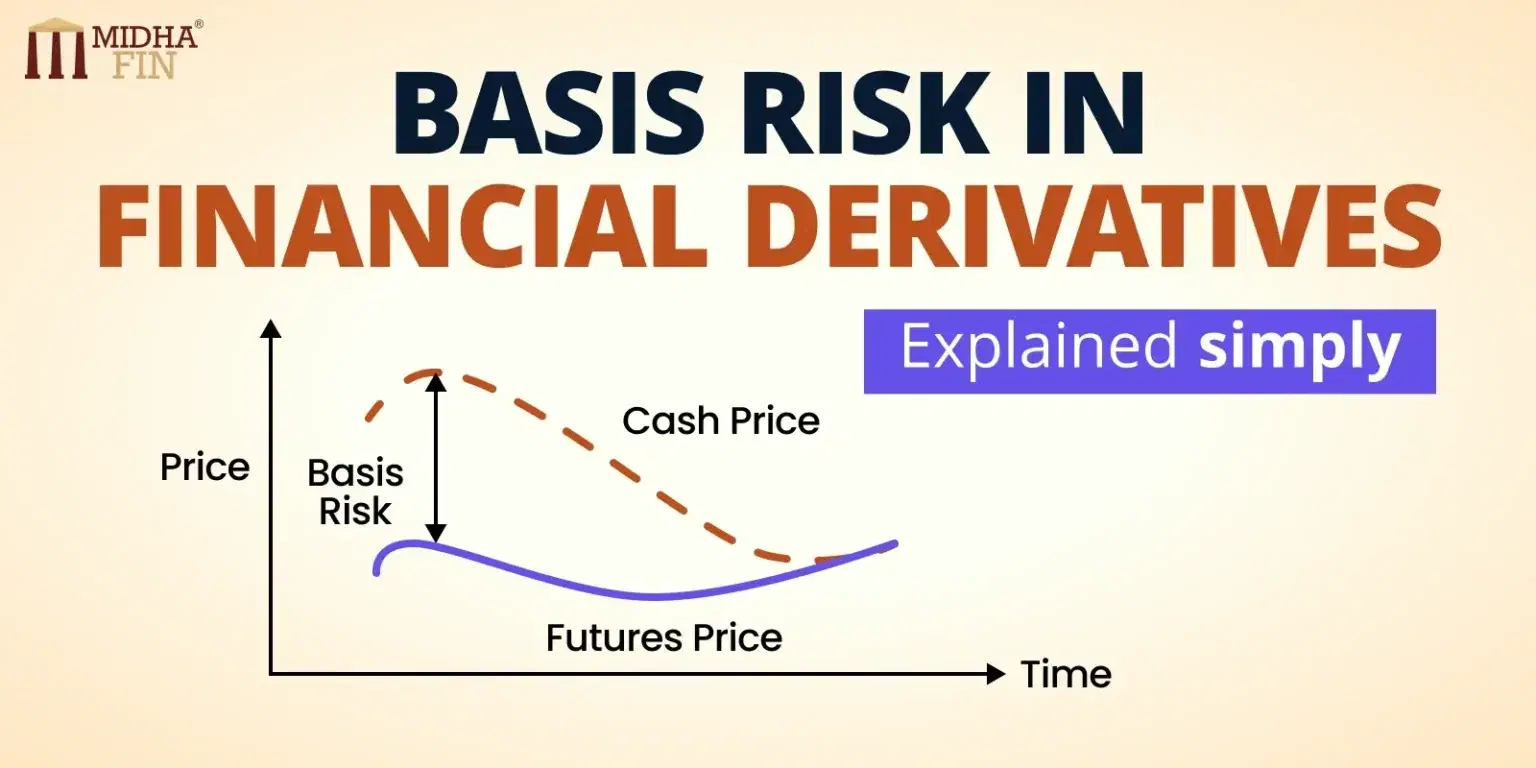

Basis risk happens when the price of a hedge instrument (like a futures contract) doesn’t perfectly match the price of the underlying asset (like a stock or commodity). Think of it like trying to cover a hot pan with a lid that doesn’t quite fit; some steam will always escape, representing the residual risk.

Key Components of Basis

- Spot Price: This is the current market price of the asset. Imagine it as the price tag you see if you were to buy it today.

- Futures Price: This is the agreed price for buying or selling the asset at a future date. It’s like pre-ordering something at a set price.

Calculation of Basis:

Basis = Spot Price – Futures Price

Factors Influencing Basis Risk in Financial Derivatives

- Time to Maturity: As the contract gets closer to its end date, the spot and futures prices usually align more closely, reducing the basis risk.

- Supply and Demand: Changes in supply and demand for the asset or the futures contract can widen or narrow the basis. For instance, if suddenly everyone wants to buy gold, the spot price might shoot up more than the futures price.

- Interest Rates and Carry Costs: Higher costs for storing and insuring the asset can increase the basis.

- Market Sentiment and Economic Indicators: Broader economic events, like political instability or inflation, can also affect basis risk.

- Seasonal Factors: For commodities like wheat or corn, planting and harvesting seasons can cause significant basis fluctuations.

Real-World Examples of Basis Risk

- Agricultural Commodities: A wheat farmer hedges against price drops by selling wheat futures. However, if a drought causes the spot price to rise more than the futures price, the hedge won’t cover the full price increase, leaving the farmer exposed to some risk.

- Energy Markets: An oil refinery uses futures contracts to hedge against fluctuations in crude oil prices. If geopolitical tensions cause a spike in the spot price of oil without a corresponding rise in futures prices, the refinery faces a basis risk that could lead to higher costs than anticipated.

- Interest Rate Swaps: A company engages in an interest rate swap where they pay a floating rate based on LIBOR but receive a fixed rate. If the company’s underlying exposure is linked to a different benchmark rate, such as the prime rate, any divergence between LIBOR and the prime rate creates basis risk. This mismatch can result in unexpected financial outcomes.

Implications of Basis Risk in Financial Derivatives

- Hedging Ineffectiveness: If the hedge doesn’t move as expected, it won’t fully protect against price changes, leaving some risk uncovered.

- Financial Impact: Poorly managed basis risk can lead to unexpected financial losses.

- Operational Challenges: Managing basis risk requires constant monitoring and sophisticated models, adding to operational costs and complexity.

- Regulatory Considerations: Effective basis risk management is often required by regulators to ensure compliance.

Strategies for Managing Basis Risk

- Monitoring Basis: Keeping an eye on the basis helps predict its movements. Advanced analytics and real-time data are crucial here.

- Dynamic Hedging: Adjusting the hedge ratio regularly to align with market movements can reduce basis risk.

- Using Basis Spreads: Strategies like calendar spreads can help manage basis risk by leveraging price differences between various futures contracts.

- Diversification of Hedging Instruments: Using a mix of options, swaps, and futures can provide more flexibility and reduce risk.

- Stress Testing and Scenario Analysis: Simulating different market conditions helps prepare for extreme movements.

- Leveraging Technology and Automation: Advanced technologies and automation can enhance accuracy in managing basis risk, making timely adjustments easier.

Conclusion

Basis risk is a key aspect of managing financial derivatives and hedging strategies. By understanding its components, the factors influencing it, and employing effective management techniques, traders and risk managers can navigate market complexities better. Regular monitoring, dynamic hedging, strategic trading, and leveraging technology are all crucial steps to mitigate the risks associated with basis movements. This approach ensures more stable and predictable financial outcomes, enhancing overall hedging performance and providing a robust framework for managing financial uncertainties.